One of the thrills of blogging the great green wave of cannabis legalization in the US is being witness to landmark historic moments. Your humble author, as a Generation Xer, never thought I’d see the day. This is one of those times in history. The cannabis legalization movement has picked up a most remarkable ally: Banks!

The SAFE Banking Act so far

The SAFE Act (Secure and Fair Enforcement Act) is legislation proposing to regulate and allow banks to handle money from the cannabis industry without exposure to federal legal liability.

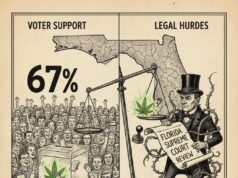

Currently, progress for the SAFE Act looks good. It passed the US House of Representatives in April of 2021, with a vote of 321-101 showing broad bipartisan support. It is now sitting on the Senate desk, with decent chances of passing there too.

We have Senate Majority Leader Chuck Schumer’s word that he would try to advance marijuana legalization at the federal level. Analysts say that there are 60 votes in the Senate for passing the bill, which again shows bipartisan support. The only potential roadblock, ironically enough, is president Joe Biden, who has so far not smiled upon ending marijuana prohibition.

Biden is a riddle within this bureaucratic enigma. He served as vice president under Obama, who was so far the best pal of cannabis legalization the White House has seen in recent decades. Biden’s own veep, Kamala Harris, is famously the co-sponsor with Cory Booker of a bill to decriminalize cannabis at the federal level. Harris has been vocal in supporting an end to marijuana prohibition.

Let’s put it this way: 69% of Americans support legalizing marijuana now. When is the last time 69% of Americans agreed on ANYTHING? Can we even know? Democrats are looking at a midterm election next year where they hope to hold the House and Senate, and that grip is slippery right now. For Biden not to approve the SAFE Act after passing House and Senate would be political suicide.

The American Bankers Association is calling for reform

Right there on the American Bankers’ Association (ABA) website, they lay out their official position on cannabis banking. They’re all for it!

More specifically, they find themselves in a position where the course of least resistance is to approve full banking services for the cannabis industry.

I’m in a unique position to explain this, since I’ve worked at a bank. It was the headquarters of a major multinational institution you’ve doubtless heard of, and was the final office job I had before fleeing the corporate world for the freelance lifestyle. So I can perhaps break down the intent behind the ABA’s memo.

Briefly, the ABA Position points out that banks’ hands are getting tied. The rift between state-level legalization and federal-level prohibition means that banks in legalized states are surrounded by businesses trading in cannabis, while being unable to legally touch any of the money.

This has a secondary industry effect. As the memo points out, even if you’re not doing business with a cannabis dispensary directly, they are still part of the industrial retail infrastructure. Like any business, they need buildings, landlords, utilities, store fixtures, employees, insurance, all the stuff that makes a business run. If you bank with a business which supports the cannabis industry and makes profit off the back of that industry, the money is still “tainted” in the sense that cannabis is still federally illegal.

Take, for instance, the case of second-party contractors working within the cannabis industry. Dispensaries outsource their need for custodial services to third parties. There’s security guard and janitorial contractors who work with the cannabis industry, and they’d normally be legally safe to bank with. But not in this case. As the ABA states:

> “…any contact with money that can be traced back to state marijuana operations could be considered money laundering…”

Of course, you and I know that it would be ludicrous to actually accuse a bank of money laundering for doing business with a cannabis-related company. But that doesn’t matter; banks must operate 101% within the law, to the letter, even where it doesn’t make sense. Banks are under federal jurisdiction. Remember, they also have to be federally insured, and right now the US federal government is in a catch-22 with any bank that does business with the cannabis industry. So it doesn’t matter what the states legalize.

The ABA even sent a joint letter to Congress, supporting H.R. 1996, the SAFE Banking Act. It outlines again the case, not only for cannabis businesses, but for doing business with ancillary businesses with ties to the cannabis industry.

> “Although we do not take a position on the legalization of marijuana, our members are committed to serving the financial needs of their communities – including those that have voted to legalize cannabis.”

This expresses the nut of the matter right here, the perfect banker’s stance. No idealism here, just business.

What is the banking industry’s actual motivation?

Of course, banks are businesses. Stay with me here. Sit down for this one if you haven’t heard it before. But banks are kind of blue in green states right now because they are missing out on the money.

Banks do make a profit off financial services after all, and if the local economy has a considerable chunk of itself tied up in money you can’t touch, that cuts into your profit. More importantly, there’s the regulatory hassle. Remember, this extends beyond mere money-handling. Businesses need checking, payroll, and accounting services. They have employees who need to pay income taxes they have to withhold. No business operates in a vacuum.

So even if the banks are not missing out on some profits, they still have to go to extra pains and jump through legal hoops to keep their hands clean when dealing with these ancillary services. Right now, dispensaries have to deal mostly in cash, which is a huge hassle not just at the point of sale, but at the taxing and bookkeeping level. Not to mention the exposure to cash-motivated crimes.

Cannabis is a multi-billion dollar business in the US right now, and growing every year. Ironically, cutting the cannabis industry out of the financial infrastructure makes the industry harder to regulate.

But moreover, we’re seeing completely pragmatic reasons for cannabis legalization to take these new federal steps. We have the US cannabis market volume projected up to $40 billion annual in a couple years, and that might prove to be a conservative estimate the way things are going. You can’t just chop $40 billion out of the national economy every year and say, “nah, we’ll just ignore it because it’s technically illegal.”

Let this be a lesson to all of you!

Why not make both love and money? They’re not mutually exclusive, you know!

I’d like to remind all of you who would normally draw these artificial lines between progressive (liberal) values and big business interests. Once again, progress is good for business in general. Progressive, liberal politics create new markets and industries. They stimulate the economy from the bottom up. Businesses, banking included, thrive in an atmosphere of greatest personal liberty.

We have the proverbial “strange bedfellows” here of the ABA and stoners. Did you ever think you’d see the day?

Readers, what are you, a silent majority? Is it time for federal cannabis legalization and industrial support? Do you have any supportive comments to this effect to share in the comments or in our forum?